R12 – E-Business Tax – ZX

Oracle E-Business Tax covers “standard” procure to pay and order to cash transaction taxes, with the exception of withholding taxes and those taxes handled by the Latin Tax Engine solution.

In general the limited per module 11i setup has been changed to become a proper self-contained tax engine. With that however comes complexity to the extent that E-Business Tax almost can be regarded as a module in itself.

Hopefully some best practices can be applied here so over time we will have a good template of standard solutions depending on type of business and geographical region.

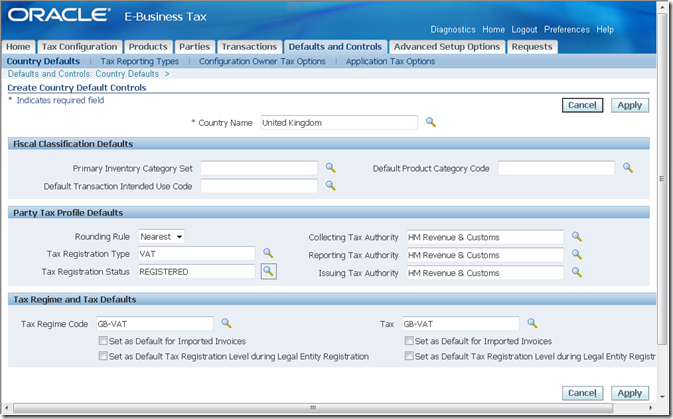

E-Business tax fully use the TCA and legal entity data model so all involved parties in tax reporting must be defined in TCA – like HM Revenue and Customs – and your reporting business unit must be defined as a legal entity too.

E-Business Tax also introduces many new concepts like:

- Tax Authority: organisation responsible for collecting taxes

- First Party Legal Entity: your organisations that have taxable transactions

- First Party Legal Establishment: your organisation having tax registration in order to report and settle taxes

- Tax Regime: Name of an area of tax like VAT in the UK

- Tax Zone: Grouping of Tax Regimes

- Tax Jurisdiction: The geographical boundary of a tax related to a tax regime

- Tax: Defines name of a tax within a Tax Regime – like VAT

- Tax Status: Level of taxes within a tax regime – like Standard, Reduced, Exempt and Zero

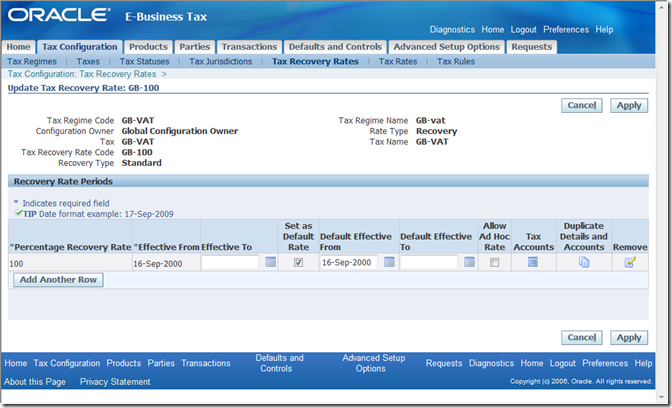

- Tax Recovery Rate: Rate of a recoverable tax – like Full (100%) and None (0%)

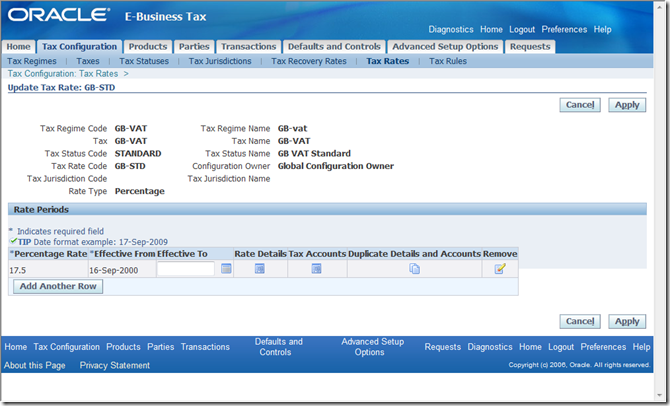

- Tax Rate: Rate of tax applied to an transaction – like Standard would have 14%, 17.5% and 15% depending on date

- Tax Rule: Rule which is applied to a transaction to provide for the tax calculation for:

- Determine Place of Supply: Determine the location for transaction

- Determine Tax Applicability: Determine what taxes apply to a transaction

- Determine Tax Registration: Determine tax registration number for the transaction

- Determine Tax Status: Determine the level of tax applicable

- Determine Tax Rate: Determine the rate based on the tax level

- Determine Taxable Basis: Determine the amount taxable

- Calculate Tax Amounts: Determine the tax amount

- Determine Recovery Rate: Determine the recovery rate

So quite an expansion of the 11i definitions in one form having a single line of tax code and tax rate…

Anyway before doing a major setup exercise have a read of the note: in Note 463001.1 – which may save you the setup for Europe.

An example of UK VAT to follow:

The section below is only tested on Vision – which is not a live system.

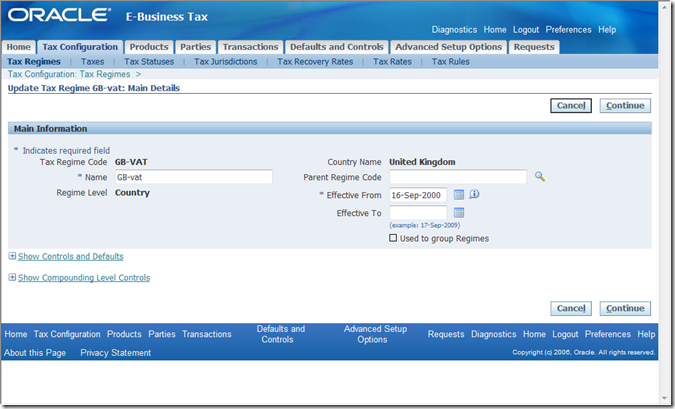

Tax Regimes

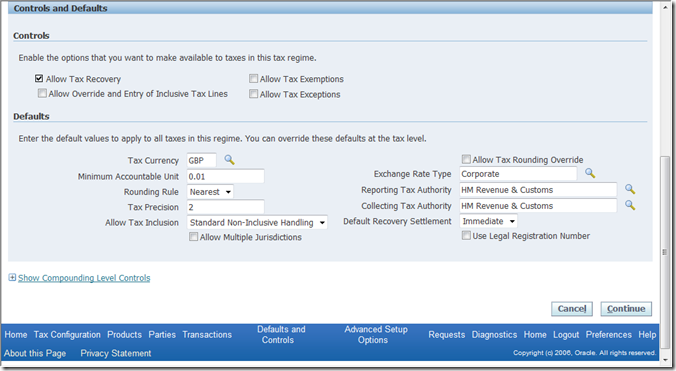

Controls and Defaults

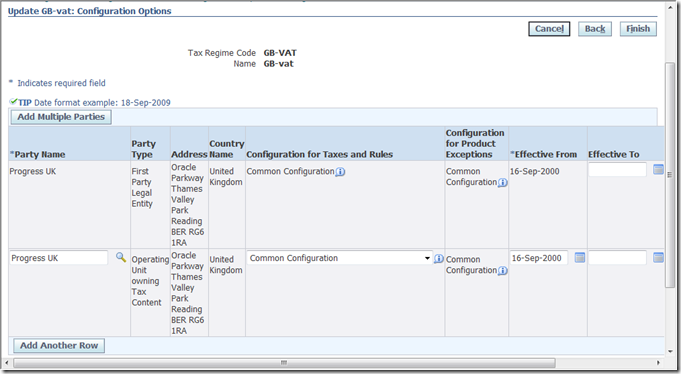

Associations

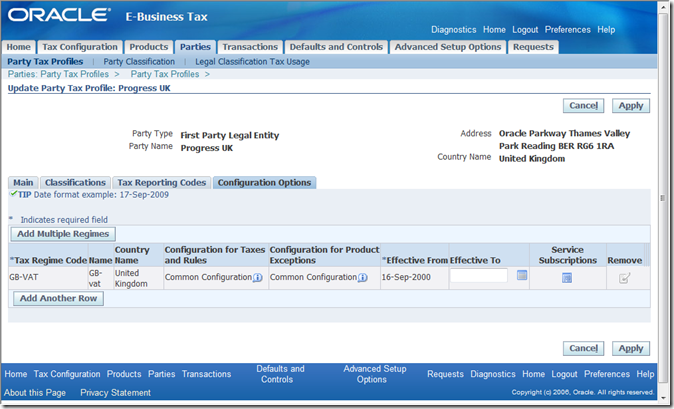

All first party legal entities and operating units must be associated with the tax regime they are subject to.

Party Tax Profiles

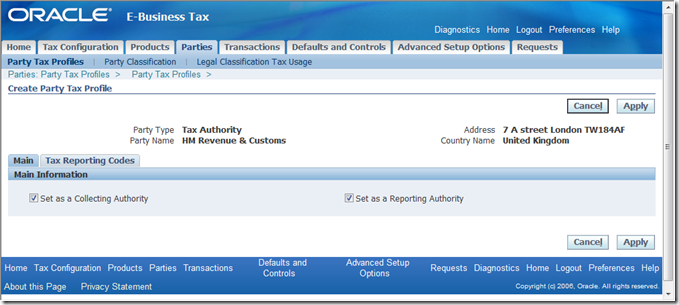

Tax Authority

This is the organisation to whom you must report and settle taxes.

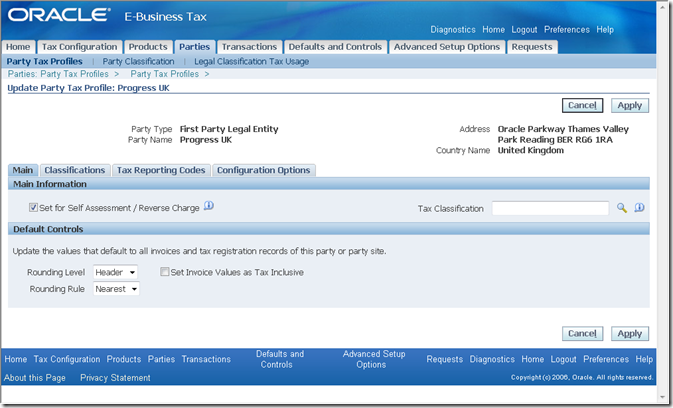

First Party Legal Entity

This is a organisation that creates taxable transactions.

– Configuration Options

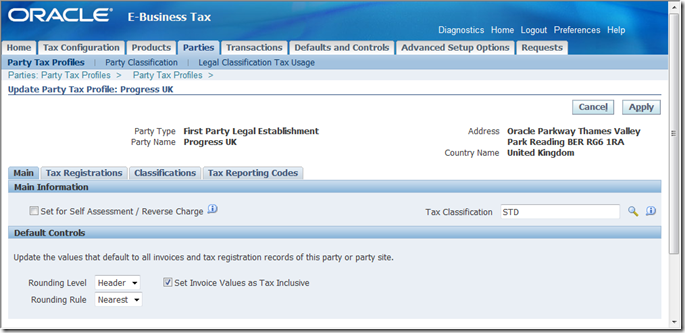

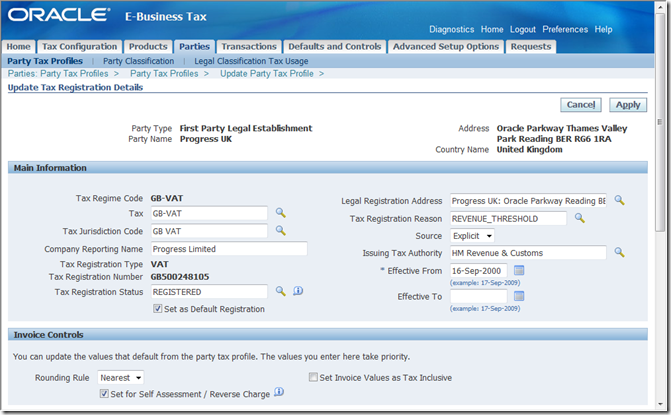

First Party Legal Establishment

This defines your organisation that reports and settles tax with the tax authority hence here you define you tax registration details.

– Tax Registration

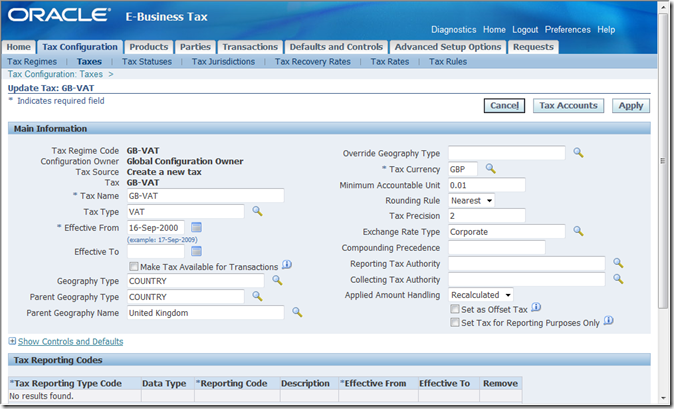

Taxes

This is the name of the tax and how it is handled.

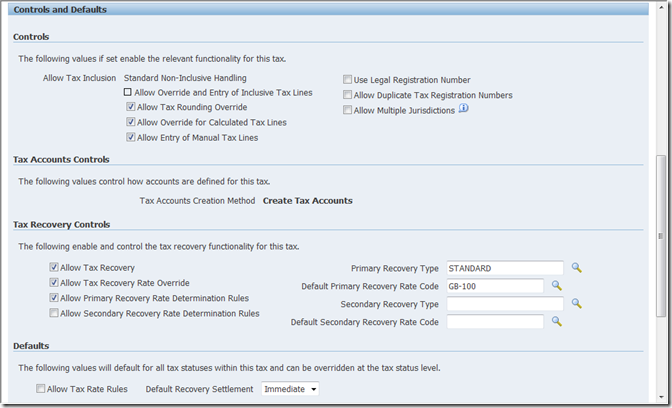

Controls and Defaults

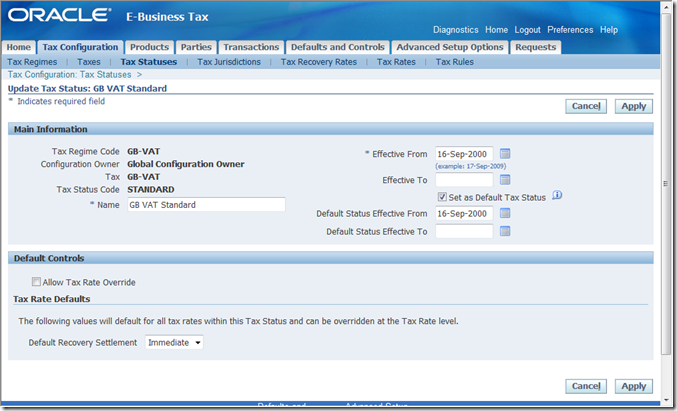

Tax Statuses

These are names of tax levels so in the UK the STANDARD VAT is for all basic goods and services but a REDUCED rate is paid for fuel and power and ZERO would be paid for food and books. Do not put the actual rate in the name is you would in 11i as this will be defined in the Tax Rates section.

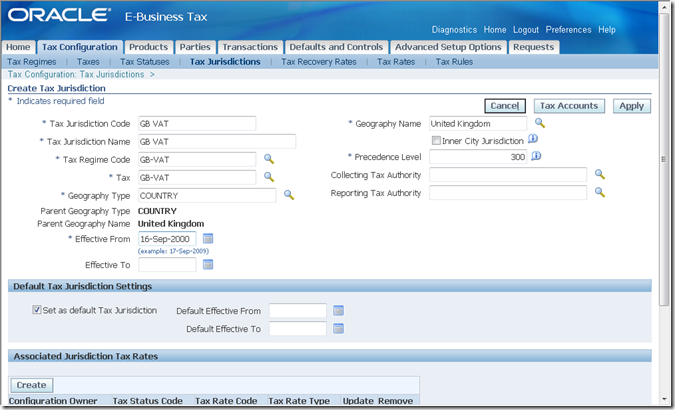

Tax Jurisdictions

Tax Recovery Rate

Tax Rate

This is rate of a tax status like STANDARD VAT would have been 14%, 17.5% and 15% over time.

Country Defaults

Setup the default tax configuration for a country.

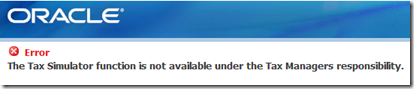

Tax Simulator

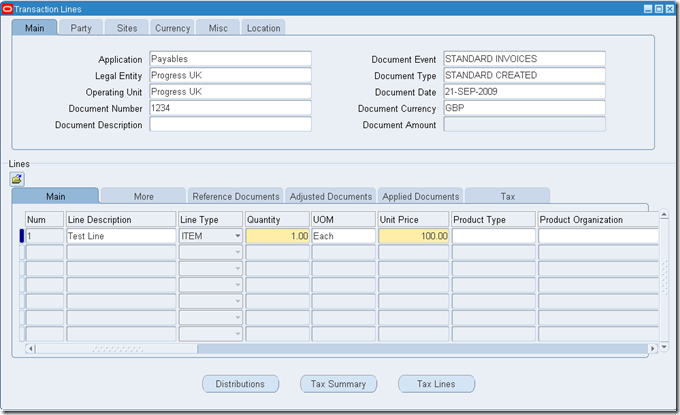

Use this screen to simulate the tax setup without entering real transaction. This is very useful when changing the configuration on a live system.

Be sure to assign the “Oracle Tax Simulator” responsibility to the user and use this rather than using the menu on the home page of “Tax Administrator” – otherwise you will get this error:

So from the “Oracle Tax Simulator” responsibility use:

And you will see this:

When clicking \Tools\View Tax Log:

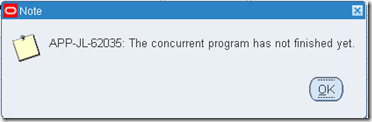

A concurrent job will be submitted. You may be get this error:

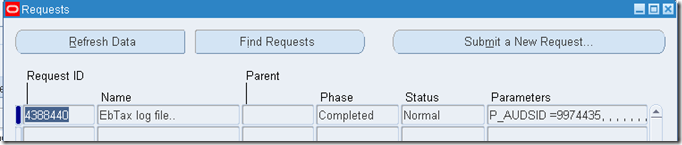

However this is not any issue – just wait a bit and retry or just monitor the request in \View\Requests:

This report will show how the tax was calculated.